Taxes on possession and operation of real estateQuit rent No specific tax is levied on property owners. Is Malaysian entitled for RPGT exemption.

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia

REAL property gains tax RPGT is a tax charged on gains arising from the disposal or sale of real property or shares in a real property company RPC.

. In March 2017 Malaysia joined the Inclusive Framework on BEPS as a BEPS Associate and is committed to the implementation of 4 minimum standards ie. Property taxes can be troublesome and. Alternatively the homeowner may own a land larger than 1 acre or earn more than RM 500000 through yields from the properties.

Youll pay the RPTG over the net chargeable gain. Countering harmful tax practices. Malaysia Budget 2017 is looming up and there are already signs in the market that significant changes are coming along.

An Act to amend the Income Tax Act 1967 the Petroleum Income Tax Act 1967 the Real Property Gains Tax Act 1976 the Labuan Business Activity Tax Act 1990 and the Goods and Services Tax Act 2014. And with the new RPGT rates announced in the Malaysian Budget 2019 Malaysian citizens will now be charged 5 in property taxes after the 5th year as well where it used to be 0. If you owned the property for 12 years youll need to pay an RPGT of 5.

In the announcement of Budget 2014 every property owners have to pay RPGT at a 30 for properties sold within 3 years or less 20 for properties disposed within 4 years and 15 for properties disposed in 5 years. 2 Subject to this Act the tax shall be charged on every ringgit. Some items in bold for the above table deserve special mention.

Bear in mind that this exemption is only limited to residential property disposal. That means it is payable by the seller of a property when the resale price is higher than the purchase price. The RPGT rates as at 201617 are as follows.

Hence this tax only applies to the property seller. May be stamp duty and real property gains tax implications associated with these transfers but exemptions are available subject to conditions. The Statutory Reserve Requirement SRR Ratio was reduced from 4 to 35 in January 2016 EPF contributors were given the option to reduce their compulsory contributions from 12 to 8 in February 2016 and the Overnight Policy Rate.

IMPOSITION OF THE TAX Taxation of chargeable gains 3. Central Bank of Malaysia. No guide to income tax will be complete without a list of tax reliefs.

1974 on 6th December 1973. A much lower figure than you initially though it would be. The base year for the Real Property Gains Tax RPGT has been revised to Jan 1 2013 for assets acquired before the date from Jan 1 2000 previously.

Yes for Malaysian it is a once in a lifetime provided that you have not applied before and you have not sell any property before. This tax was introduced to curb property speculation and the soaring prices of immovable property especially residential houses during the years 1973 and 1974. In tandem with the Governments aspi ration to modernise the tax syst em it was proposed in Budget 2015 that tax on gains from the disposal of property be self-assessed by the taxpayer effective from the year.

2017 PUA 402017 Full exemption of stamp duty on all instruments in relation to facility Stamp Duty Exemption Order B. The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble. Disposal in 6 th year and subsequent year.

1 A tax to be called real property gains tax shall be charged in accordance with this Act in respect of chargeable gain accruing on the disposal of any real property hereinafter referred to as chargeable asset. ENACTED by the Parliament of Malaysia as follows. Currently gains from the disposal of property under the Real Property Gains Tax Act 1976 are assessed formally.

ChApTER I PRELIMINARY Short title 1. It was introduced in 1975 under the Real Property. Selling Property 1 Real Property Gains Tax RPGT RPGT is a capital gains tax levied by the Inland Revenue Board on chargeable gains derived from the disposal of property.

5 Hike Since 2019. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. RPGT Act Through The Years 1976 2022 RPGT is a tax on profit.

When an individual citizenpermanent resident company or foreigner purchases a property in Malaysia and later decides to sell it heshe will be subjected to property tax on the profitchargeable gains made from the sale of said property. Non-citizens and companies on the other hand will be charged 10 RPGT when they dispose of their property after more than five years from purchasing it. PwC 20162017 Malaysian Tax Booklet CONTENTS National strategic projects Oil gas Property Construction Research development Regional operations Telecommunication Tun Razak Exchange Others Income Exempt From Tax Double Tax Treaties and Withholding Tax Real Property Gains Tax Scope RPGT rates Returns and assessment Date of disposal.

To have commercial property to be taxable under the 6 GST the homeowner must own 2 or more commercial properties or a commercial property valued at more than RM 2 million. The rate varies with land category and size but in general the annual quit rent liability is less than RM100 on a residential property. In the above example where your gain was RM250000 the RPGT payable would be RM 50000.

However individual state governments levy a land tax known as quit rent or cukai tanah which is payable yearly to state authorities. In simple terms a real property includes land or immovable property with or without title. This Act may be cited as the Finance Act 2017.

So if youre a Malaysian citizen and you sell a property after holding it for four years you would be liable to pay RPGT at 20 of the chargeable gain. Above RPGT Rates in Malaysia as of Budget 2014. Technical or management service fees are only liable to tax if the services are rendered in MalaysiaWhile the 28 tax rate for non-residents is a 3 increase from the previous years 25.

Which is why weve included a full list of income tax relief 2017 Malaysia here for your calculation. In Malaysia there is no capital gains tax until the introduction of Land Speculation Tax Act. RM 63000 RM 1400 RM 9000 RM 4400 RM 48200.

RM 50000 RM 250000 x 20. An RPC is a company holding real property or shares in another RPC which value is not less than 75. This was done during the tabling of Budget 2020 which is imposed on profit earned by homeowners and businesses by selling property.

Of course these exemptions mentioned in the example are not the only one.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

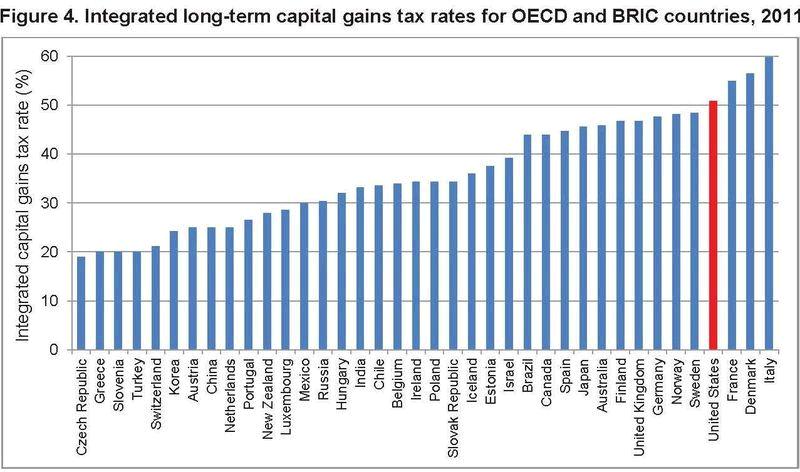

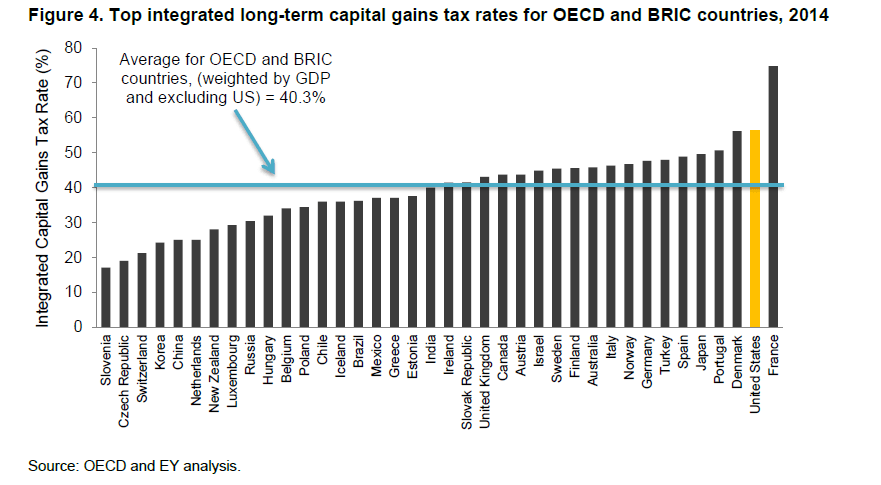

International Capital Gains Tax Rate Comparison Where Does The Us Stand Topforeignstocks Com

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gains Tax Part 1 Acca Global

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Understanding Rpgt Legally Malaysians

43 4 Capital Gain Tax 10 Things To Know

You Are Cordially Invited To Our Pre Vip Launch Of Freehold Apartment Near Malaysia Klcc Price From Rm1 29mil 1 Mi Property Investor Development Investing

International Capital Gains Tax Rate Comparison Where Does The Us Stand Topforeignstocks Com

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan